Special Assistant to Senate President Bukola Saraki, on New Media, Bamikole Omishore has accused Sahara Reporters and Sahara Reporters Foundation of evading taxes both in the United States of America where it claims to be registered and in Nigeria.

He stated that details of multiple bank statements by the Sahara Reporters Foundation in the last one year shows inflow of hundreds of millions of Naira from questionable sources but no evidence of tax payments or exemptions.

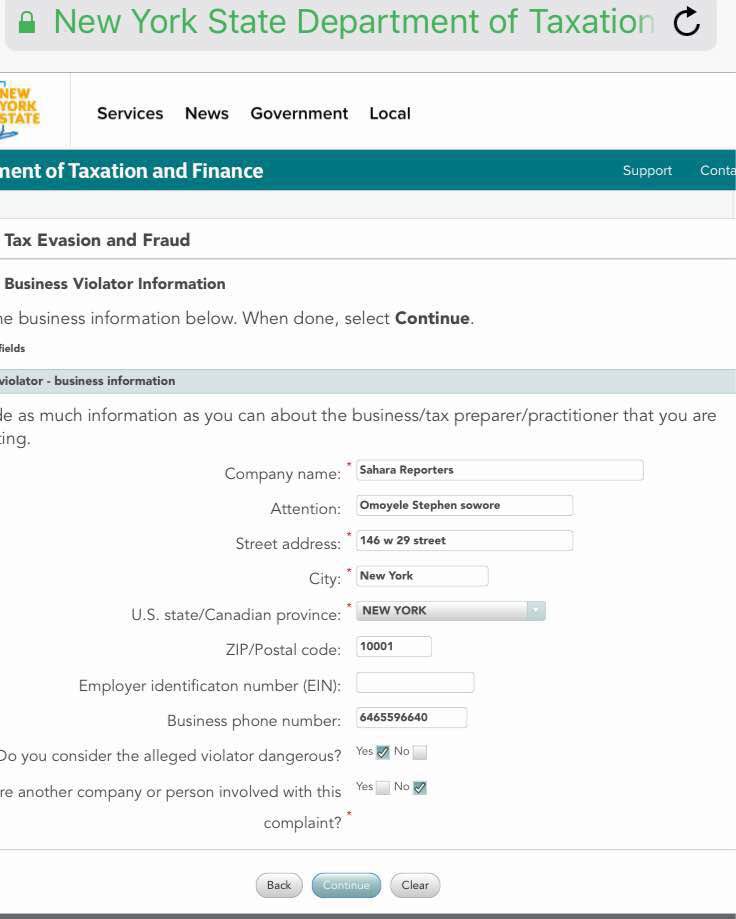

Disclosing that Omoyele Sowore of the foundation refused to provide evidence of tax clearance after being requested to do so, the petitioner stated that as a good citizen of Nigeria and America, he had filed a petition with the Internal Revenue Service, IRS, in the U.S. and also notified the Federal Inland Revenue Service, FIRS, in Nigeria to probe the tax status of Sahara Reporters and Sahara Reporters Foundation.

Omishore acknowledged that although some non-government organisations and non-profit firms were exempted from tax, they were still required to file an annual tax exemption form and make it available to the public.

“Over the years, Sahara Reporters has claimed that it is not registered in Nigeria but only registered in New York in the U.S., hence he does not have to be held accountable under Nigerian law on anything.

“I somewhat disagree with him on that, if you are a registered business in New York, even though you are trading in Nigeria, you ought to be registered in both places, most especially if you are running accounts that collects funds from international organizations, Nigerian businesses and questionable individuals.

“A private citizen sent me details of multiple bank statements, with two Banks in Nigeria with some of the accounts showing the last three years transactions that Sowore of Sahara Reporters Foundation has had with these banks.

“The transactions for last year alone ran into hundreds of millions of naira, from foreign organizations, politicians and other questionable transfers, including cash deposits of tens of millions in one day.

“In Nigeria you are supposed to report every income and pay taxes on them, as a foundation even though NGOs do not pay taxes, by U.S. laws, NGOs are required to file for tax exemptions as the law provides that: “All tax exempt organisations must annually file the Internal Revenue Service (IRS) form 990 an informational tax form. This form gives the IRS an overview of the organisation’s activities, governance and detailed financial information.

“The non-profit must disclose to the public upon request, three of the most recently filed tax exempt forms and the organisation’s tax exempt status.

“Many charitable organisations post this on their websites, what this is meant to do is to make sure that terrorist organisations, drug dealers or corrupt politicians do not use the NGO as a money laundering tool to destabilise the world economy”.

Omishore added that this led him to file a petition against Sowore for refusal to file his tax documents in the last three years for Nigerians to see if it correlates with the hundreds of millions that passes through his bank statements.

He said that the bank statements did not even include some funds which Sahara Report received as donations from foreign organisations adding that a certain foundation even publicised its donation of $450,000 to Sahara Reporters.

The petitioner continued, “I am only saying that for the sake of posterity, the American government should clarify if truly Sahara reporters, is registered in America and the country is in support of the organization ‘s activities of collecting money from questionable sources”

“I have filed a petition to the IRS to know the status of Sahara Reporters foundation, a copy of the petition is attached to this. He is collecting money on behalf of Nigerians and saying he is registered in New York: We just want to make sure no law is being broken in Nigeria and in U.S.

“I have contacted FIRS in Nigeria over this matter as well and I will also follow up with both tax institution. I had given him the benefit of the doubt to provide his tax exemption or evidence of payment which he refused to do, now the onus lies on Sowore to clear his name”.