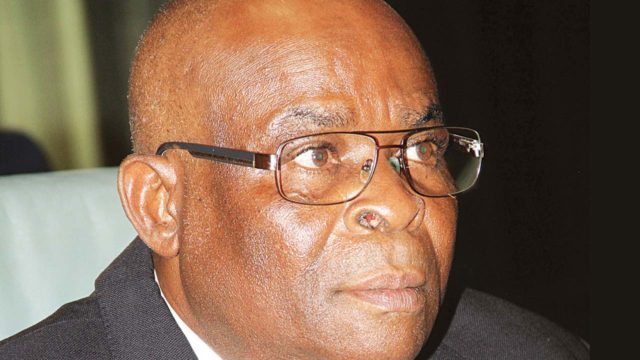

The National Judicial Council (NJC) will hold an emergency meeting today over the suspension of the Chief Justice of Nigeria (CJN), Walter Onnoghen.

The meeting will be held in Abuja by 10:00 a.m. Sources say neither Onnoghen nor Ibrahim Mohammed, the acting CJN will be allowed to preside over the meeting.

Also, the Nigerian Bar Association (NBA) has scheduled an emergency meeting for today. The president of the association, Mr. Paul Usoro (SAN), announced the meeting on Friday.

The body of lawyers in Nigeria had earlier condemned the CJN’s suspension. It is certain that the association will decide on the next line of action with regard to the crisis.

Already, many of the past presidents of the association such as Dr. Olisa Agbakoba (SAN) are insisting that the body must resist the action, which they consider an assault on the constitution.

Meanwhile, the tensed political atmosphere in the country ahead of the forthcoming general elections may have serious consequences for the economy and the citizens.

Already, investors are interpreting the tension, now engulfing the judiciary, as “uncertainty”, “instability” and erosion of the rule of law capable of degenerating into anarchy and impacting investments negatively.

An economist, Chuma Nzerem, told The Guardian that “investors are usually highly averse to perceived uncertainty, especially with political maneuverings, deterring foreign investments.”

Since the last four months, when political activities took an upswing, the activity level in the Investors’ and Exporters’ (I&E) FX Window has been low, with frequent back and forth weekly movement and falling to $549.9 million three weeks ago, against a near average of $900 million weekly.

The economy has been weighed down by ongoing domestic concerns like the resurgence of Boko Haram attacks in the North East and the clashes between cattle herders and farmers that impacted agricultural output negatively.

Consequently, the Gross Domestic Product (GDP) from the agricultural sector lost 1.16 per cent from 3.07 per cent recorded in the third quarter of 2017, to grow by 1.91 per cent in Q3 2018, while heightened capital outflows on the back of rising yields in developed countries and uncertain domestic political environment held the economy hostage since August 2018.

The All Share Index (ASI) of the Nigerian Stock Exchange (NSE), which was the third best performing stock market in 2017, contracted by 17.81 per cent, as investors exited the market and repatriated capital.

“It is worse, when the rule of law, as it is now, is subjected to ‘rule of thumb’ just to achieve political end. It is a signal that the justice system can be bent, and foreign investors get wary.

“They are watching, and I am afraid there would soon be a pressure on foreign exchange market (forex) due to capital flight, especially if the next meeting of the United States Federal Reserve falls within the election period, with rate hike. Otherwise, yields on government’s securities will increase to compensate risks valuations.”

He said the United States of America and the United Kingdom- Nigeria’s top sources of foreign investments, through their embassies, had already warned against the ongoing “annexation” of the country’s judiciary.

“With Nigeria’s oil production now capped at 1.6 million barrels per day (mbpd) by the global oil cartel, against 2.3mbpd 2019 budget benchmark and uncertainty in oil prices, which has direct link to exchange rate and forex reserves, political maneuverings capable of sending wrong signals to investors would be punitive to the economy.

“Specifically, the ongoing brickbat and mudslinging against the judiciary and its stakeholders are certainly not raising the much-needed business confidence for investors, who may need the sector’s services for resolution of ensuing investment challenges.”

The Lead Director of Centre for Social Justice (CSJ), Eze Onyekpere, lamented the continuation of the alleged anti-investment policy that President Muhammadu.